Inside your client’s mind: Thinking, saving, and planning for retirement

The following findings offer deeper insights into what workers, retirees, and plan sponsors are experiencing related to retirement planning and financial well-being.

FINDING 1

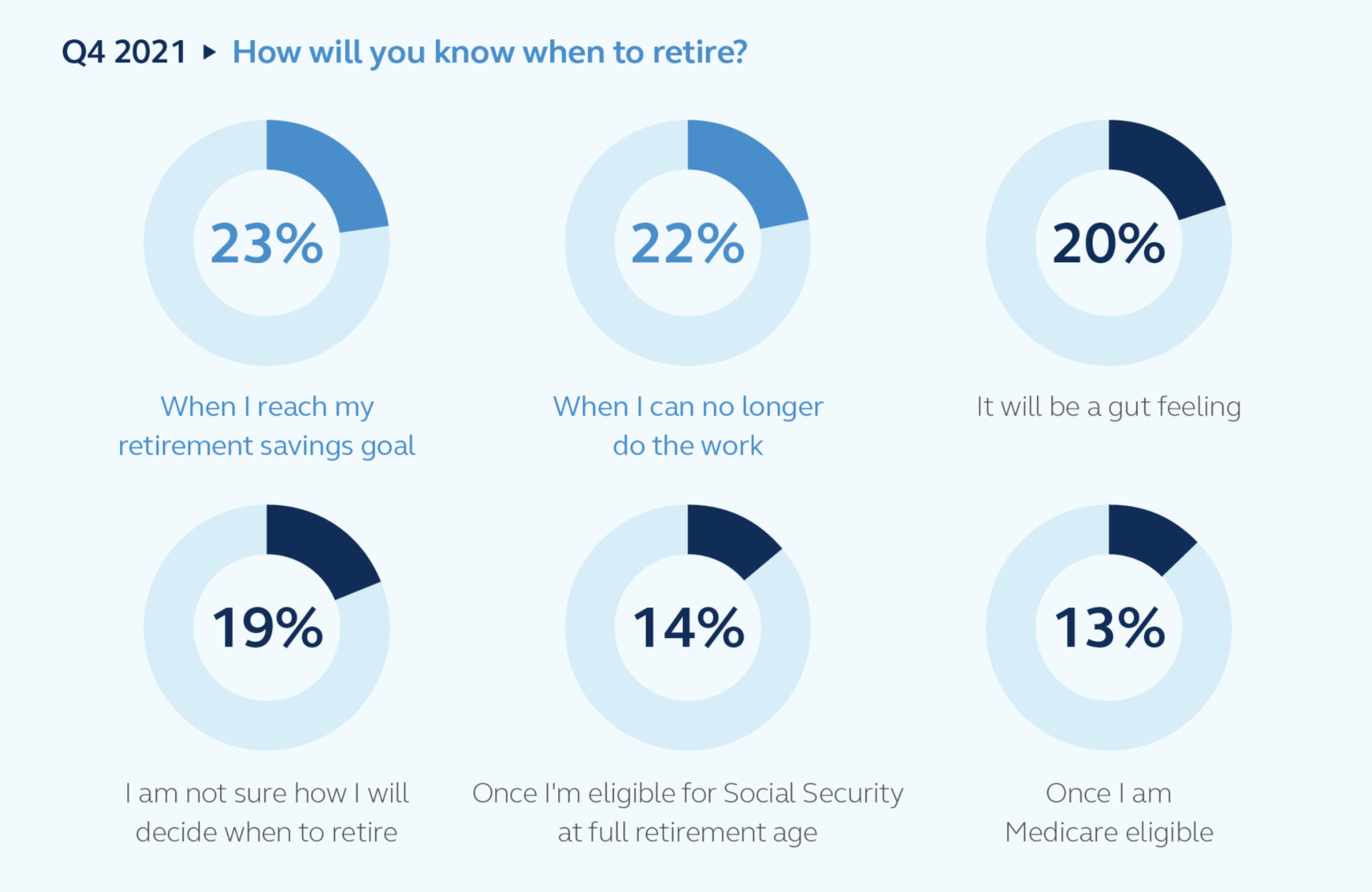

Workers consider different influences when determining when to retire.

Historically, the consideration of ‘when to retire’ was driven primarily by the date or age a working person could begin collecting Social Security and pension or defined benefit plan payments. And it was common for workers to delay retirement to maximize income from these sources. Today―possibly due to uncertainty with Social Security and a decline in employer-sponsored pension and defined benefit plans―workers consider other factors when determining when to retire.

Interestingly, 'gut feeling' is on the decline.

We see a difference between generations when comparing the top influences on deciding when to retire:

- Gen X: 25% “When I reach my retirement savings goal.”

- Baby Boomers: 20% “It will be a gut feeling.”

- Retired: 22% “I retired when my pension or defined benefit monthly amount was significant.”

Note that only 10% of non-retired Baby Boomers selected this as a top influence.

Your client’s planned retirement age and actual retirement age might not match

Despite retirement being prompted by different factors, on average today’s workers still plan to retire at age 65. This differs slightly from the actual average retirement age of 63.5.1

Since 2017, there’s been a notable increase in people leaving the workforce between 60-65 years old.1

FINDING 2

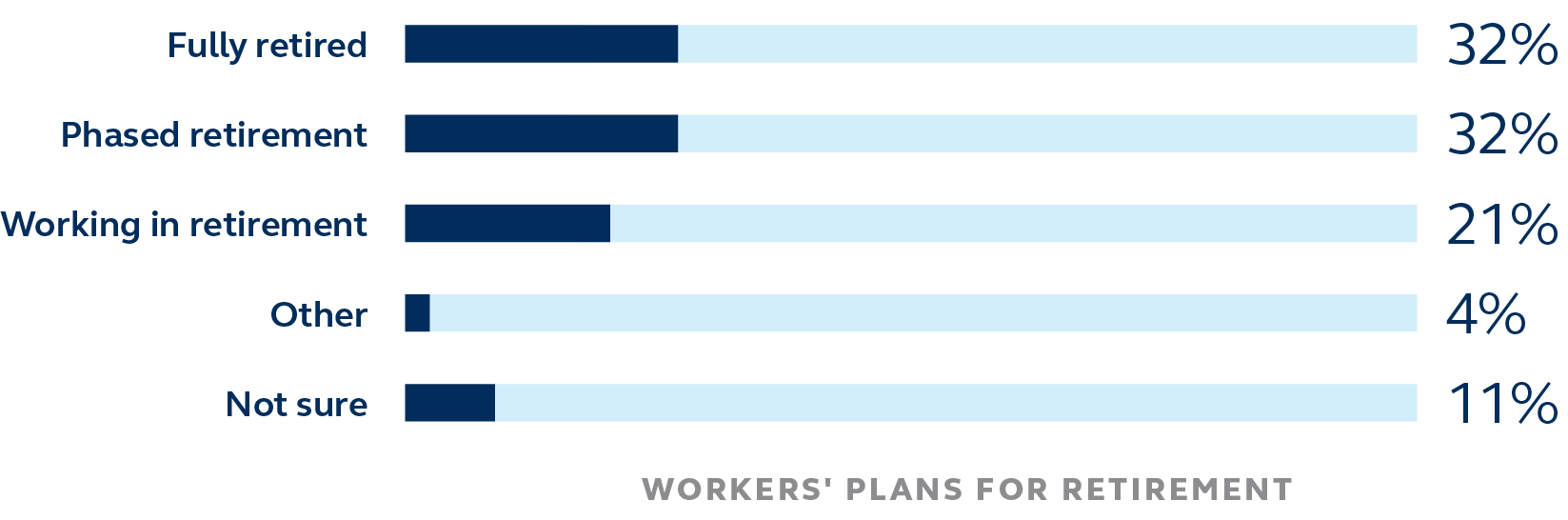

Your client’s retirement doesn’t necessarily mean leaving work behind.

Plans to work when retired may change as workers approach and enter retirement.

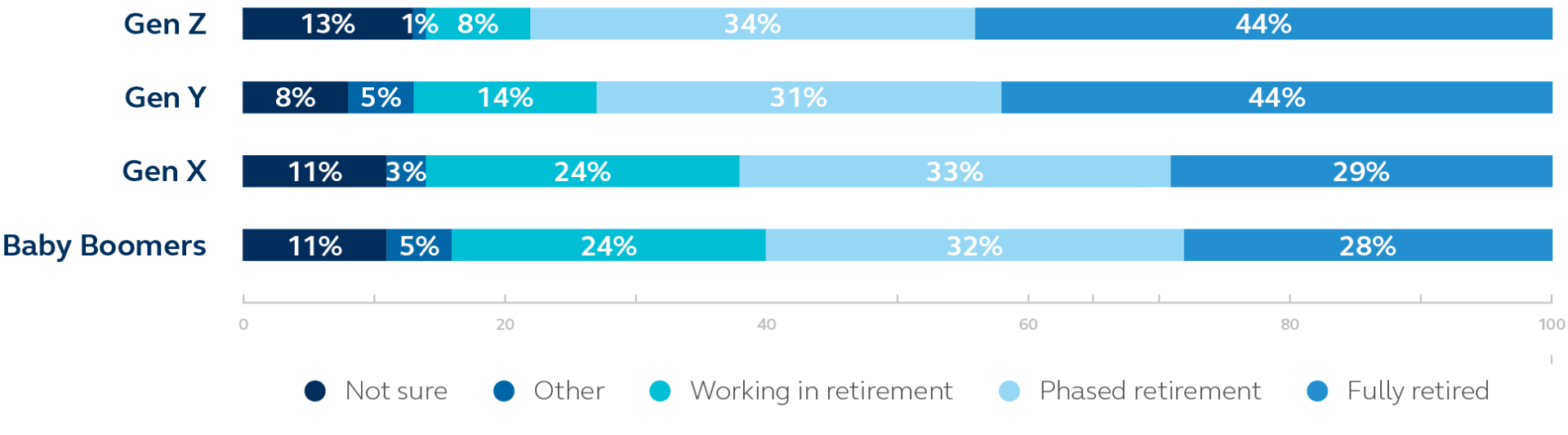

Intent to continue working in retirement varies by generation

Looking more closely, the intent to continue working in retirement is held most strongly by the older working generations of Gen X and Baby Boomers. Thinking about retirement, workers see themselves:

Contact

Ironwood Retirement Plan Consultants

Office: 661-735-1558

Fax: 661-840-5571

5060 California Avenue, Suite 600

Bakersfield, CA 93309

Subscribe to our newsletter

We will get back to you as soon as possible.

Please try again later.

Securities offered through Purshe Kaplan Sterling Investments, Member FINRA/SIPC., Headquartered at 18 Corporate Woods Blvd., Albany, NY 12211. Purshe Kaplan Sterling Investments and Barnes Wealth Management Group are not affiliated companies. Not FDIC insured. Not bank guaranteed. May lose value, including loss of principal. Not insured by any state or federal agency

The Purshe Kaplan Sterling Investments representative associated with this website may discuss and/or transact securities business only with residents of the following states: California (CA), Michigan (MI), Oklahoma (OK), Oregon (OR), and Pennsylvania (PA).

Copyright 2022 Ironwood Retirement Plan Consultants